Last Updated on June 16, 2023, 12:05 PM | Published: June 15, 2023

This is our site version of the Personal Finance Newsletter that went out to subscribers on June 1. New editions are coming out roughly every two weeks. If you would like to subscribe to helpful information like this, simply fill out the form at the end of this article.

Credit scoring is a system used by lenders, such as banks, credit unions and credit card companies, to assess the creditworthiness of individuals and determine the likelihood of them repaying their debts on time.

It is a numerical representation of an individual’s credit history and helps lenders make informed decisions about granting credit, setting interest rates, and determining credit limits.

In addition, your credit score can play a role in rental applications, employment prospects, insurance premiums, utility service applications and other services.

Maintaining a good credit score is essential for financial well-being. It opens up opportunities for better credit options, helps save money through lower interest rates, and allows for greater financial flexibility in various aspects of life.

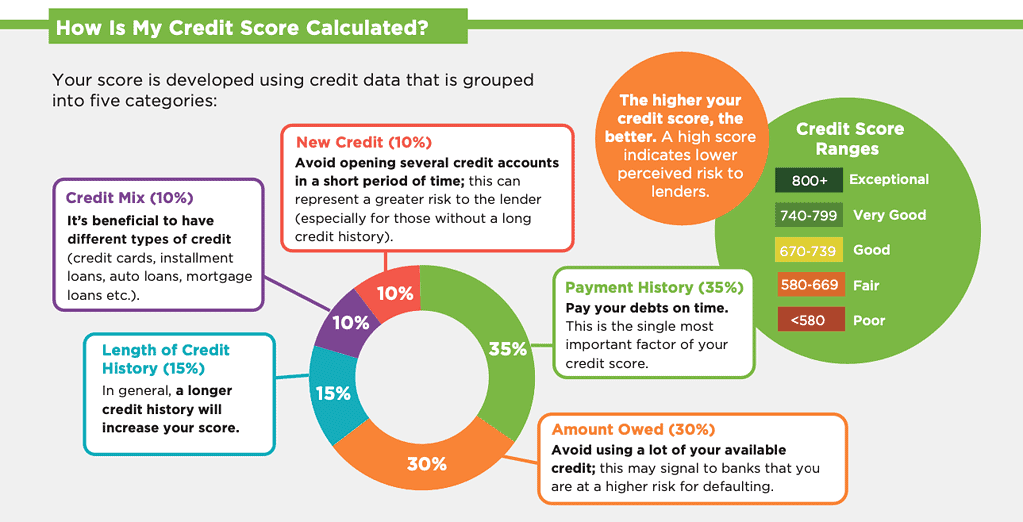

The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. The FICO score ranges from 300 to 850, with a higher score indicating better creditworthiness. These are the 5 Factors that make up your credit score

Here are 5 tips to improve your credit score:

- Pay bills on time: Payment history is a crucial factor in credit scoring. Make sure to pay all your bills, including credit card payments, loans, and utility bills, by their due dates. Late or missed payments can significantly impact your score.

- Keep credit card balances low: Aim to use a low percentage of your available credit. Ideally, keep your credit card balances below 30% of the total credit limit. High credit utilization suggests higher credit risk and can negatively affect your score.

- Maintain a healthy credit mix: Having a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your score. It demonstrates your ability to manage different types of credit responsibly.

- Avoid opening unnecessary credit accounts: While having a healthy mix of credit is beneficial, opening multiple new credit accounts within a short period can be seen as a risk. Only apply for new credit when necessary.

- Regularly review your credit report: Obtain a free copy of your credit report from each of the major credit bureaus (Equifax, Experian, and TransUnion) annually and review it for errors or discrepancies. Dispute any inaccuracies promptly to ensure your credit information is correct. To obtain a free copy of your credit go to – annualcreditreport.com

Remember, improving your credit score takes time and consistent financial habits. By following these tips and maintaining responsible credit behavior, you can gradually enhance your creditworthiness and achieve a better credit score.

True Sky Federal Credit Union believes in helping people establish or improve their credit score. Come into any location and ask for a Co-Pilot Credit Analysis – it’s FREE! You can sit with a trusted advisor and have a personal analysis of your credit.

True Sky Federal Credit Union also offers a free service to help assess your financial health. In just minutes, analyze your financial situation. Understand your cash flow and know where you stand with your debt. With this simple tool, you can learn how to build a budget, compare debt payoff strategies, and get tips on how to be better with your money. Follow this link to get started!

Daniel Garcia is a trusted advisor with over 25 years of financial services experience. For assistance in learning more about the financial instruments mentioned in this newsletter, contact Daniel at (405) 205-3308.