Last Updated on June 14, 2023, 10:41 PM | Published: June 14, 2023

This is our site version of the Personal Finance Newsletter that went out to subscribers on April 27th. New editions are coming out roughly every two weeks. If you would like to subscribe to helpful information like this, simply fill out the form at the end of this article.

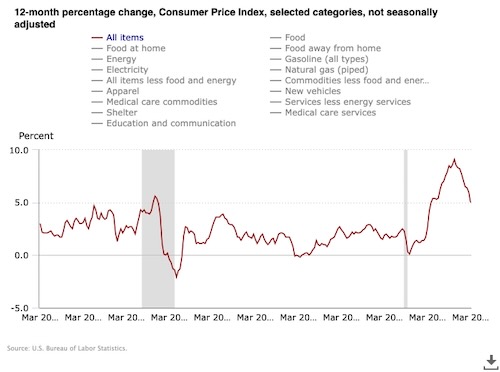

In today’s current economy what used to cost $400 is closer to $600 just taking inflation into account. The average American household is unable to keep up with the historic acceleration of inflation that reached over 9%. Most are feeling the financial strains just to keep up with essentials and the economic outlook is enhancing uncertainties.

The first step to consider during times of financial distress is to take an honest measure of your personal budget. When was the last time you tracked your expenses? Through this basic process alone many times you’ll discover some discretionary expenses that could be modified or eliminated.

Personal savings is always going to be the best solution to overcome unexpected expenses and uncertainties. We can all agree that finances play a significant role not only in economic prosperity but in overall well-being and quality of life. Learning the discipline of saving will certainly prepare you for the next event. Consider these for example:

- Medical emergency expense – $500

- Child-related activities or events – $250

- Cost of new tires for your car – $600

- Replacing hot water tank – $800

In my financial experience, these are just a few common expenses that are often unexpected and can quickly cause personal financial distress. Perhaps you have some savings built up or you recently received an income tax refund – have you explored your options to maximize your savings and cover expenses like these?

Here are some practical tips to help build up or manage your savings and some borrowing options to think about:

Maximize Savings

- Open a Certificate of Deposit (CD) – most are earning over 4% for 12-month terms

- Use a Money Market Account – these accounts pay higher dividends and keep your funds available

- Sub-Savings Accounts – facilitate budgeting for specific expenses

Explore Borrowing

- Borrow & Save Loan – loans with affordable repayment that include a savings component for future needs

- Quick Loan – a fixed rate not based on credit score to help cover unexpected expenses with a low repay

- Savings Secured Loan – maintain your savings and borrow at a low rate against your own funds

Daniel Garcia is a trusted advisor with over 25 years of financial services experience. For assistance in learning more about the financial instruments mentioned in this newsletter, contact Daniel at (405) 205-3308.