Last Updated on March 11, 2021, 1:05 PM | Published: March 11, 2021

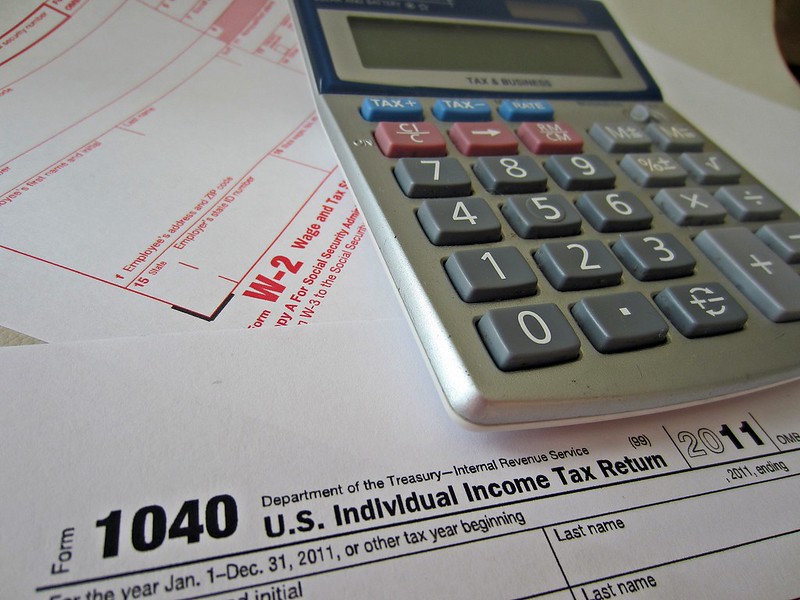

At this point during the tax season, if you made some money doing work as an independent contractor or with your own small business, you might think your taxes are too complicated to prepare and file yourself.

Maybe you have shopped around and decided that a tax preparation software such as Intuit’s TurboTax software might not answer all of your household’s questions about taxes going forward.

If you live in Oklahoma, you have until June 15th, 2021, to file your 2020 income tax return, so you have a little extra time to find a tax preparer.

If you decide to use one, here are a few tips regardless of what kind of tax expert you hire.

Basics

Ultimately, the household taxpayer is responsible for information on a tax return, not a tax preparer, so the household signing and filing a tax return should always inspect that return before filing it.

The household should not sign a blank return for a tax preparer to fill in.

Taxpayers should be extremely cautious of tax preparers who charge a percentage of a tax refund, keep a tax refund for themselves as compensation, or promise larger tax refunds than other tax preparers.

Taxpayers should also make sure their tax preparer is around throughout the year. A taxpayer may need to ask a tax preparer questions about past returns if the IRS or a state taxing authority such as the Oklahoma Tax Commission sends a letter of inquiry or assessment to a taxpayer.

All tax preparers must also have a Preparer Tax Identification Number or PTIN, and any tax preparer filing over 10 returns in a tax season must use IRS e-file.

Lastly, a tax preparer should not ask a taxpayer to do anything clearly illegal regarding their tax return such as fill in a line for tax deductions with false information or underreport income.

Future representation

Attorneys, certified public accountants (CPAs), and enrolled agents before the Internal Revenue Service may represent taxpayers in all tax matters involving the IRS.

These matters can range from preparing tax returns and assisting a taxpayer with tax disputes involving audits and collection actions. Others without any of these three designations can still prepare tax returns, but cannot represent a taxpayer in disputes such as court proceedings.

Attorneys

When it comes to filing taxes, attorneys can prepare and file taxes. Not every attorney specializes in tax preparation, but the ones that do often specialize in other business and money-related law matters such as estate planning, contract writing, and starting a corporation.

All attorneys must take continuing education classes to keep their law license, and any attorney who specializes in tax law should focus their continuing education on tax, business, and personal finance matters.

If you feel you need an attorney licensed in Oklahoma to do your taxes this year, the website to visit is okbar.org.

CPAs

Certified public accountants may also prepare taxes and represent taxpayers before the IRS.

As with attorneys, not all CPAs specialize in tax matters. CPAs that do specialize in taxes often prepare and inspect returns for other taxes, such as sales taxes.

CPAs can also help with filing other quarterly or monthly taxes, and CPAs can also audit a company’s financial statements for banks or other lenders or groups that need audited statements.

CPAs, like attorneys, must also do continuing education to keep up with tax and accounting topics. The website to find a CPA in Oklahoma is oab.ok.gov.

Enrolled agents

Enrolled agents before the IRS, or EAs, may also prepare and file taxes. EAs typically only focus on taxes, but their sole focus on taxes makes them experts at any tax issue.

The EA exams are administered directly by the IRS and all support for the EA designation is run directly by the IRS, while the bar exam for attorneys and the CPA exams are run by state governments. Since the EA designation is a federal designation, EAs may practice in any state. To find an EA, visit taxexperts.naea.org.

There are groups and companies that hire people to prepare tax returns without any of the above certifications. These people and groups can often handle simple returns, but as your return and needs grow in complexity, you might outgrow an uncredentialed tax preparer.

Taxes are often stressful and complicated. Finding the right tax preparer can help you with small business and personal finance knowledge to take some of the stress of taxes and finances off of your mind.

The above information should be a starter to finding a good professional who can take care of tax needs as well as accounting or legal needs for a gig worker’s small business as well.

John Mazurk is a CPA who formerly worked for the Oklahoma Tax Commission. He has a passion for giving good financial tips no matter the cost.