Last Updated on September 4, 2022, 6:59 PM | Published: April 1, 2022

This is the third in an ongoing series where we explore the dynamics of the affordable housing crisis in the Oklahoma City metro.

OKLAHOMA CITY (Free Press) — For the first time since 2019, the Oklahoma Coalition for Affordable Housing was able to bring Affordable Housing Day to the Capitol.

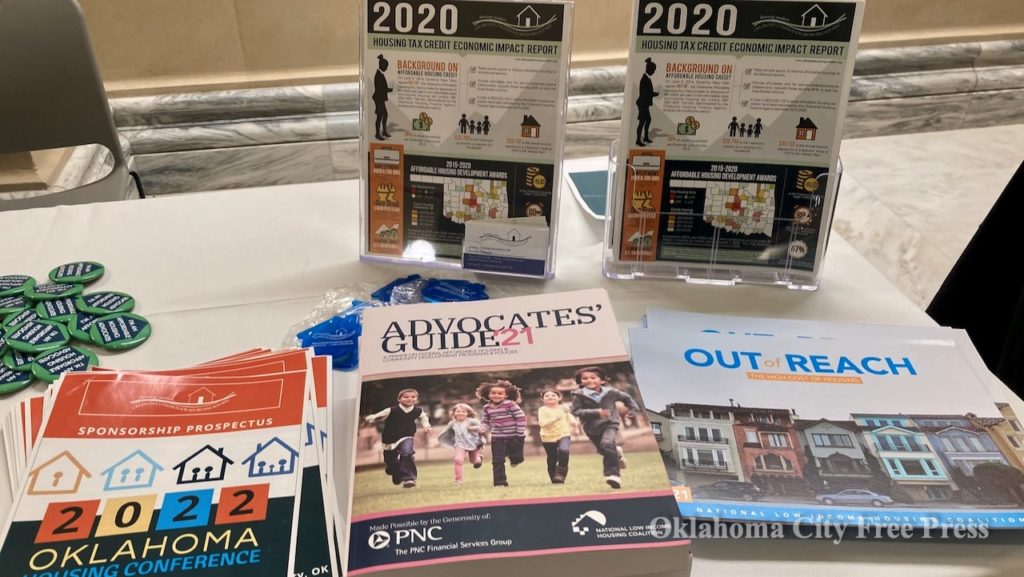

Ostensibly an annual day of glad-handing and pamphlet-passing to bring housing affordability issues directly to state legislators, the OCAH was prevented from holding the event over the past two years because of pandemic concerns. But, Thursday, March 31st saw them back in full swing, knocking on office doors and chatting with representatives.

One Coalition member in attendance was LW Development CEO, and previous Free Press interviewee, Lance Windel.

“Our group, you know, half of us are for-profit developers and the other half are nonprofit advocates for housing or homelessness,” Windel said. “So it’s an interesting mix, but the only way we can truly take a stand is if we all agree on what’s good for housing for Oklahoma.”

Legislative Affairs

While OCAH’s Affordable Housing Day is primarily focused on providing Coalition members an opportunity to meet face-to-face with senators and representatives, and to put any of their extensive collection of data packets and books in those legislators’ hands, it’s also a chance to discuss the group’s official positions on the year’s housing-oriented bills.

In years past, there have been some highly contentious pieces of legislation working through the Capitol that the Coalition sought to put their full force against. Chief among those bills in recent memory was 2020s SB 2760, which would have cut the Low-Income Housing Tax Credit (LIHTC) allocation for the state in half, from $4 million to just $2 million.

“We got a Governor veto of that,” said Andrea Frymire, VP of Community Investments for Midwest Housing Equity Group, and one of OCAH’s leaders, of the group’s successful campaign to stop the credit cut even after the bill had passed both houses of the state legislature. “It just comes down to our members being super engaged.”

Support and Opposition

This year’s legislative session doesn’t include anything quite so dire for the Coalition.

In fact, there are currently only three bills on the table that relate to housing development or the tax credit allocations on which low-income builders largely rely:

SB1168 – This bill would place a strict limit of just 180 days on all real estate “contingencies,” requirements such as permitting, zoning, appraisals, and any other necessary inspections that a property must pass before selling or being approved for renting.

The OCAH firmly opposes this bill, stating unequivocally on their website that 180 days “is simply not enough time for our developments.”

Proponents of the bill in the legislature claim that this time limit would only apply to state-contracted developments, but the language of the bill makes no such distinction, forcing the Coalition to outright oppose the bill unless the language is rewritten.

SB1685 – This bill, on the other hand, has almost universal support throughout the Coalition.

SB1685 would amend existing legislative language in order to “decouple” state-issued housing tax credits from federal housing tax credits.

In 2014, the Coalition was instrumental in helping to pass the “Oklahoma Affordable Housing Act,” a landmark bill for Oklahoma housing that allocates $4 million in state tax credits annually to low-income housing development, exactly matching the $4 million of federal LIHTCs granted to Oklahoma each year.

This doubling of available credits and funding for affordable housing in the state was a major victory, but due to strict readings of the bill’s language, the state has thus far been required to match any amount of federal credits granted to a project to the exact dollar for that same project. This means that if a LIHTC-approved development is granted $250,000 in federal credit, the state Housing Finance Agency is required to grant that project’s developers another $250,000, whether or not that amount is actually needed to finance the development.

The result has been higher profits for the lucky few builders that get approved for LIHTC funding, but with the level of competition around those tax credits for affordable housing development (as we covered in the previous installment of this series,) it has meant far fewer low-income developments can be funded.

OCAH says that “decoupling” the state-granted tax credit amounts from the federal amounts would result in more funding credits being made available for low-income housing builders all across the state.

HB3409 – The most contentious bill currently among OCAH members themselves, this act would increase the amount of reimbursement that a tenant can demand after making their own repairs on a property if a landlord has not attended to them in a timely manner.

Unsurprisingly, this bill hasn’t found common ground within the Coalition’s ranks.

As that “interesting mix” to which Windel referred includes both “tenant’s rights” advocates and many landlords themselves, OCAH leaders have chosen to stay neutral on this issue, while still watching the bill closely, as it’s already made its way from the House to the Senate.

Future Funding Hopes

In addition to tracking these bills and passing out information packets all over the Capitol showing legislators the benefits and effectiveness of things like the LIHTC and the Oklahoma Affordable Housing Act, the Coalition is also looking to the future, their hopes resting heavily on more funding.

“If they increase the credit, that would be great,” Frymire told me. “The federal credit was actually reduced recently.”

Each state is allotted federal LIHTCs per capita according to its population, but developers had been enjoying an increase in that allotment for the past few years.

“We had a twelve-and-a-half percent bump to that allocation that came out of Trump’s tax reform plan,” Frymire explained. “That expired on December 31st, so we just lost twelve-and-a-half percent of our federal credit.”

Though there have been some attempts at the federal level to close that gap and return that funding bump, they have not been successful so far.

“There was some in ‘Build Back Better,’ but of course that didn’t pass,” said Frymire. “We’re always looking for more state funding, but you really just have to protect what you have.”

Previous series posts

- Affordable housing dev in OKC hamstrung by red tape, credit competition

- Complex affordable housing crisis on display across Oklahoma City

Brett Fieldcamp has been covering arts, entertainment, news, housing, and culture in Oklahoma for nearly 15 years, writing for several local and state publications. He’s also a musician and songwriter and holds a certification as Specialist of Spirits from The Society of Wine Educators.